Know More about PCI DSS Compliance and its Requirements

PCI DSS Compliance | sisainfosec.com

With payments getting digitalized, there is a need to safeguard them, irrespective of any transactions from cash registers and bank vaults to data protection technologies. The organizations like merchants, service providers, card processing institutions, etc., have to carry out sensitive customer card data safely following certain guidelines established by various card brands to safeguard card payments from any data breach, fraud or theft.

The Payment Card Industry Data Security Standard (PCI DSS) governed by PCI Security Standard Council (SSC) is the most important and essential requirements that organizations need to comply with.The PCI DSS compliance process however is not an easy task for it asks the businesses accepting, processing, transmitting and retaining customer credit or debit card data to continuously maintain and evaluate their network systems to ensure the adherence to the latest compliance requirements.

What Is PCI DSS Compliance?

The increasing use of the Internet has resulted in the increase in the levels of frauds, where the sensitive information provided on the web is vulnerable and prone to data theft by miscreants. The card payment institutions such as American Express, Visa, MasterCard, Discover, etc., had tried having their own security standards with limited success.

It was in 2006 that these institutions formed a consortium and framed and established a set of security standard requirements called PCI DSS, merchants need to satisfy to deal with any card transactions. With the PCI DSS compliance, you determine the potential exposure to any security breach when dealing with card transactions.

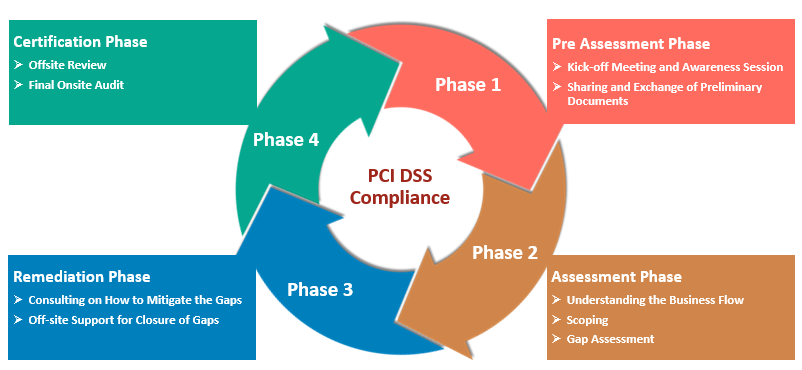

Get to Know What Is PCI Compliance Process

Any business handling the cardholder data should undergo some practices and processes conforming to PCI DSS compliance requirements. Being a continuous and complicated process, it includes the following steps:

Assessing: Identify and determine the security weaknesses through vulnerability scans, as well as penetration testing within a critical environment. Prioritizing such weaknesses depending on the impact they may have on your business and deciding on essential steps to fill the gaps before allowing the threat to materialize.

Repairing: With the data discovery tools, you get to scan the sensitive information and extract patterns of such card information retained in business-critical systems. Based on the outcome of the scans, as well as testing, the remediation process is conducted and the security processes are controlled.

Reporting: Once the remediation support and essential controls are implemented, an onsite audit is done to validate the security controls effected according to the requirements and provide the compliance and attestation reports for certification.

The security standard controls are so designed to safeguard card payment data and may differ depending on a company’s activities. Nevertheless, to conform to those security control requirements, businesses must adhere to the following principles.

Minimize vulnerabilities through strong “access control measures”

Have PCI DSS compliancy in your day-to-day operations by monitoring access to cardholder data and network resources and assessing the security control systems and processes.

Undergo continuous penetration testing within the business-critical environment

Get advice from the experts regarding adherence to PCI standards.

With four levels of PCI DSS compliance, it is up to you to find the level you fit in.