How Significant It Is to Run the PCI SLC Assessment

PCI SLC Assessment | Image Resource : sisainfosec.com

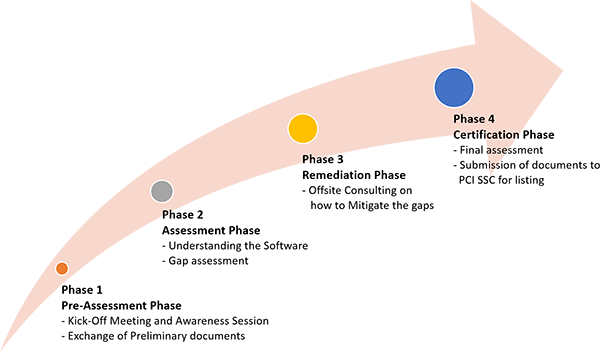

The strategies based on analytics and requirements of the PCI SLC diagrams will help ensure payment programs quite satisfactorily. It also assures the privacy and value of payment data and financial exchanges.

About nine goals of control are being offered to the sellers of payment programs. These goals ensure a far more secure and recurring occurrence of instances. These controls are bound to prove necessary going forward.

Consider Few Key Tips on How It All Take Place:

Spot and eradicate fundamental risks and shortcomings depicted in the standard of PCI Secure SLC

Turn the situation in favor of executives that are controlling alterations and advancing secure programming

Get the practices approved by showing a proof of uniformity and documenting

Facts Supported by PCI SLC Assessment at a Raised Level:

PCI SLC Assessment helps in meeting the various assessment processes and other rules of security.

Organizations that appear as the SLC assessor abide by certain validation procedures irrespective of the ability of the vendor in to following the standard of SLC security.

A specific SLC coding standard is followed by the companies that act as assessors by fulfilling the preset quality standards. They have also boasted their performance in staying compliant towards the latest PCI security norms.

Vendors that Have Become Eligible As Per the PCI SLC Evaluation Norms:

The PCI SSC list would easily identify the vendor websites that are eligible according to the security norms laid down by SLC.

The security program helps in rendering authorization for executing multiple assessments concerning software gadgets showcasing the assessor’s participation to a bare minimum. Over here, the validation of payment software creates an arrangement of software tools that got validated based on the standard of PCI security.

Matching the norms of PCI SLC Evaluation never implies any compliance or validation to different sets of SSC standards.

Currently it is not quite clear as to what the payment coding merchants will achieve out of the conformation of benefits besides yielding external authorization stating that the company is indeed abiding by the secured coding norms in pursuit of advancement.

Under circumstances when you are attempting to do a security analysis or getting things appraised, then you must abide by the Secure SLC standard. It meets all scope of filling out information. It even implies that the risk evaluators must possess a minimum of 1-3 years of experience in handling each of the risk areas of a particular industry.